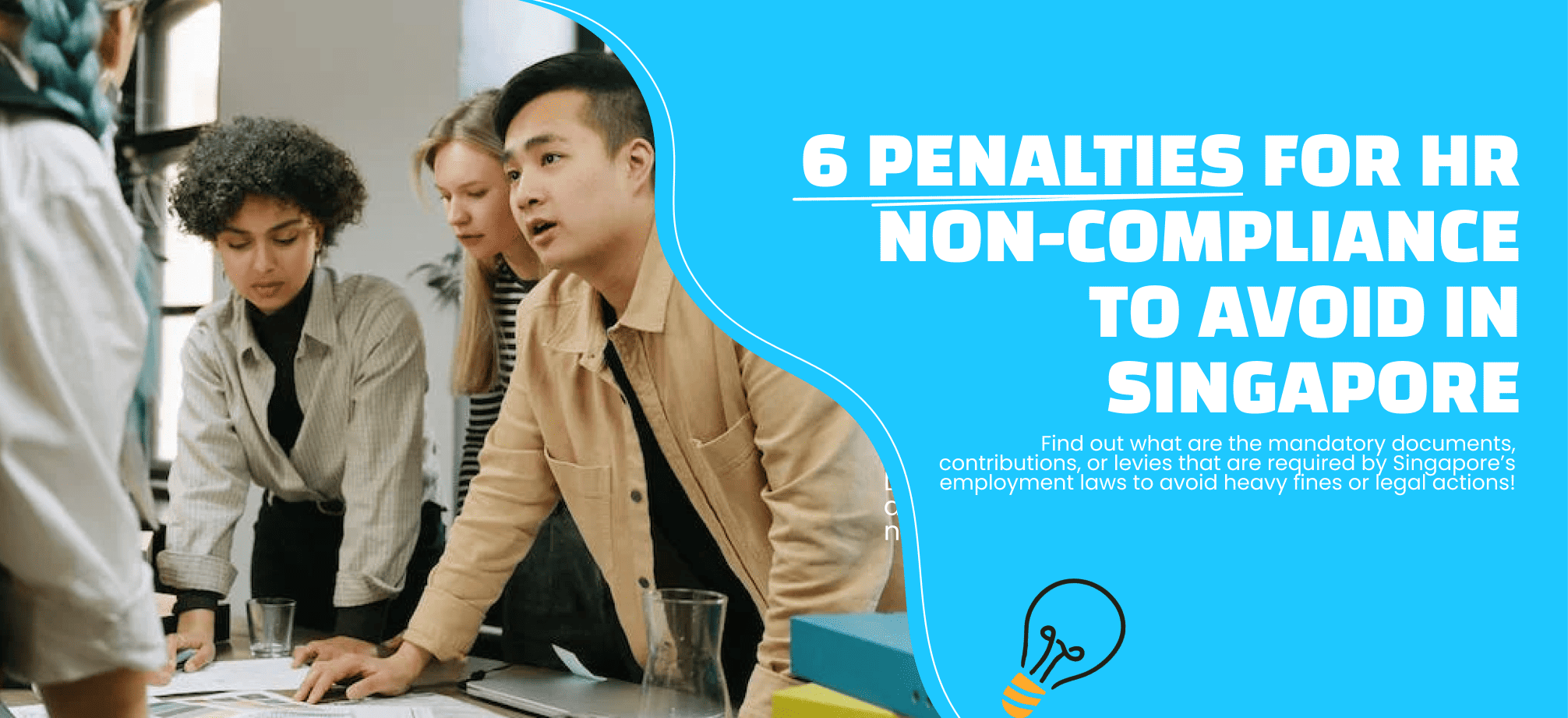

As a business owner or HR professional in Singapore, it's important to make sure you're following the country's employment laws and rules. If you don't, you could face heavy fines or legal actions. We’ve put together 6 penalties for HR non-compliance that you must avoid to err on the side of caution! Read on to find out more.

CPF Contributions

Under the CPF Act, all employers are required to pay CPF contributions for their employees who are Singapore Citizens or Singapore Permanent Residents and are earning more than $50 per month.

How to submit CPF Contributions?

There are two convenient ways to submit your CPF contributions:

- CPF EzPay: Save time by letting CPF EZPay auto-compute your contributions. You can also set up a standing instruction for recurring CPF payments.

- CPF EzPay Mobile: Submit CPF contributions on-the-go using your mobile device. Simply download the app to get started.

What is the deadline for CPF Contributions submission?

The deadline for CPF contribution submissions is the last day of the month, with an additional 14-day grace period in the following month.

What is the penalty if CPF contributions are submitted late?

If an employer fails to submit their CPF contributions within the given timeframe, they will be charged a 1.5% interest on the monthly CPF payable after the 14th day of the following month (or the next working day if the 14th falls on a Saturday, Sunday, or public holiday).

What is the penalty for non-payment of CPF contribution?

The CPF Board will first send a notice to inform the company that legal action will be taken upon detecting late or non-payment of CPF contributions. If the employer still doesn’t pay and is convicted of an offence under Section 58(1)(b) of the CPF Act, they will be liable for:

- A court fine of between $1,000 and $5,000 per offence and/or up to 6 months’ imprisonment for the first conviction.

- A court fine of between $2,000 and $10,000 per offence and/or up to 12 months’ imprisonment for subsequent convictions.

The CPF Board will also seek a court order requiring the employer to pay outstanding CPF contributions and late payment interest.

Failure to pay the employee’s share of CPF contributions despite recovering the employee’s share from his/her wages may result in a fine of up to $10,000 and/or up to 7 years’ imprisonment.

Need more help understanding CPF contributions as an employer? Here are some CPF-related guides and resources that we’ve put together:

Employees’ employment income submission to IRAS

According to Singapore's Income Tax Act, all employers must submit their employees’ employment income to the Inland Revenue Authority of Singapore (IRAS) by 1 March of every year. The submission period usually begins in January, and employers are encouraged to complete their submissions as early as possible to avoid a last minute rush.

How to submit employees’ employment income records?

All companies with 5 or more employers must join the Auto-Inclusion Scheme (AIS), which is a programme that enables the submission of employees’ income records to IRAS electronically. Submitted income information will be auto-included in employees’ tax returns for their verification and tax filing, thus reducing the need to declare their income manually and minimising errors in the tax filing process.

Here are ways to submit employee income records electronically, including:

Submission via Payroll Software with AIS API service

Employers are strongly encouraged to use payroll software that works with the AIS Application Programming Interface (API) Service to help them prepare and send employment income details. The API service makes it easy and quick for employers to send records directly to IRAS through their preferred payroll software.

In fact, Payboy is one of the supporting payroll software vendors for AIS listed on IRAS. We have achieved a strong rating of A for software compliance with controls, meaning that Payboy meets the full list of 23 recommended controls by IRAS!

Check out our IR8A and Auto Inclusion Scheme (AIS) Guide for Employers to find out why you should switch to a payroll software with AIS API service now!

Submission via myTax Portal or PAT System

Employers who do not use payroll software can prepare and submit employment income information directly via IRAS’ online digital service at myTax Portal, or use the Provident and Tax (PAT) system managed by CrimsonLogic Pte Ltd.

What are the penalties if employees’ employment records are submitted late?

Late submission of employees’ employment income records may lead to a fine of up to $5,000.

Itemised Payslips

Employers must issue itemised payslips to all employees covered by the Employment Act. These itemised payslips provide transparency to ensure that employees are treated fairly in the workplace, eliminating the room for fraud and dishonest practices.

The itemised payslip in Singapore should include the following information:

· Employer's name and UEN (Unique Entity Number)

· Employee's name

· Date of payment and pay period

· Basic salary

· Allowances, such as overtime pay or shift allowances

· Deductions, such as CPF (Central Provident Fund) contributions and taxes

· Net salary paid

· Any bonus paid and the period for which they earned it

· Any leave taken during the pay period (e.g., annual leave, sick leave, etc.)

· Any other payments made, such as reimbursement of expenses or salary in lieu of notice

How to generate itemised payslips for employees?

An employer can create an itemised payslip manually by using the payslip template provided by the Ministry of Manpower (MOM).

Alternatively, using HR software like Payboy can simplify the task of generating payslips for all your employees, as its payroll processing module not only saves time by automating the calculation of salary and deductions but also ensures accuracy and compliance with Singapore’s HR regulations.

What are the penalties if an employer fails to provide itemised payslips?

Failure to comply may result in fines of up to $1,000 for the first offence and up to $2,000 for subsequent offences.

In addition, if an employer submits false payslips after the deadline, they could face a hefty penalty of up to $5,000 and court charges.

Skills Development Levy

A Skills Development Levy (SDL) is a levy imposed on employers to fund workforce training and development initiatives for their employees. The SDL Act requires all employers to pay a monthly SDL, which is calculated as 0.25% of the total monthly remuneration paid to their employees. The amount of SDL payable for each employee varies as it depends on their monthly salary.

- For employees who are earning less than $800 a month, the minimum SDL payable is $2 per month.

- For employees who are earning more than $4,500 a month, the maximum SDL payable is $11.25 per month.

An employer can use the SDL calculator to sum up the total SDL for all employees.

How to make SDL payment?

The SDL is payable monthly with CPF contributions and collected by the Central Provident Fund (CPF) Board.

What is the penalty for late SDL payment?

An employer has to pay a penalty of 10% on the outstanding amount each year for late SDL payment.

Form IR21

The IR21 form, also called the "Employment Income Tax Clearance for Foreign Employee" form, is a mandatory statement that employers in Singapore must file when their foreign employees stop working or plan to leave the country for more than three months.

The form is used to let IRAS know that the foreign employee is no longer working so that all taxes are paid and any debts are settled before the employee leaves.

What is the deadline for submitting Form IR21 to IRAS?

Employers are required to seek Tax Clearance by filing Form IR21 or notifying IRAS at least 1 month before the foreign employee ends employment in Singapore or plans to leave Singapore for more than 3 months. Employers should therefore ensure they have sufficient time to complete the necessary procedures and submit the form before the employee's departure.

What are the penalties for late or non-filing of Form IR21?

IRAS may first request the employer pay a composition amount not exceeding $5,000 to avoid prosecution.

The employer will then be required to appear in court if they don't submit the form and pay the composition fee that IRAS has requested. Failure to attend court will result in further legal actions being taken against the employer.

What are the penalties for late or non-payment of taxes?

As an employer, you also have the responsibility to pay the monies withheld from your employee’s salary for income tax clearance, and the deadline is 10 days from the date of the Directive to Pay Tax.

IRAS typically imposes a 5% late payment penalty on the unpaid amount if you fail to pay your taxes on time. A 1% penalty is also added for every month that the tax is not paid, up to a maximum of 12 months.

More carelessness can lead to serious problems, such as travel restrictions, legal action, and the IRAS sending agents to collect taxes that haven't been paid.

Foreign Worker Levy

Employers in Singapore are required to pay the Foreign Worker Levy (FWL) for each foreign worker they hire there. The levy aims to regulate the number of foreign workers in Singapore and help fund the cost of managing and providing for foreign workers in Singapore.

When and how to submit FWL?

The levy amount depends on the sector that the employer operates in and the skill level of the foreign worker. The levy is paid on the 17th of the following month and is deducted from the foreign worker's salary. Employers can sign up for the GIRO scheme so that the levy is automatically deducted every month from their designated bank account without worrying about late payment.

What are the penalties for late or non-payment of FWL?

Employers failing to pay FWL by the due date will be charged a late payment penalty of 2% per month or part thereof on the outstanding amount. Also, any work permits that the company already has or has been given will be revoked, and legal action may be taken to get the unpaid levy back.

Read our Work Permit Guide for Employers as we walk through everything you need to know about hiring foreign workers in Singapore.

Want to avoid these non-compliance penalties? Try using Payboy HR software!

With our fully compliant, customisable, and integrated payroll processing module, you can avoid these non-compliance penalties with peace of mind!

- 100% compliant and 100% peace of mind

- Forget about payroll and levy (SDL and FWL) calculations, CPF contributions, as well as IR8A submissions. Our software will automatically calculate them for you and keep you compliant with the latest regulations from MOM, CPF and IRAS.

- Covers any work arrangement

- Working with full timers, part timers, freelancers and contract staff? We’ll take care of the unique payroll requirements for each working arrangement.

- Transparent, Accurate and Simple

- Full visibility on how payroll is calculated automatically based on shifts, attendance, leave and submitted claims, within an intuitive experience.

- Customisable itemised payslips

- Automatically generate itemised payslips for your employees.

- Fully integrated with your preferred platforms

- We’ll fit into your ecosystem seamlessly and keep your finance team happy. Learn more about our seamless integrations with Xero, Financio, and Quickbooks.

Streamline your HR processes with Payboy today!

As a PSG-approved HRMS, Payboy provides a robust system to help you manage your HR tasks so that you can focus on your business and people!

With our wide range of modules, you can customise a solution to meet the specific needs of your business: