Advance payments can be a valuable tool for employers and employees alike, offering financial flexibility and support in times of need. This guide explores what advance payments are, the common scenarios where they might be utilised, the legal framework surrounding them, and best practices for managing them effectively.

What is an advance payment?

An advance payment is a prepayment of wages or salary given to an employee before the scheduled payday. It's a way for employers to provide financial assistance to their staff when they need it most, such as in emergencies or unexpected expenses. This arrangement can be mutually beneficial, as it helps employees manage cash flow while allowing employers to demonstrate care and support for their workforce.

Advance payments can cover various types of remuneration, including base salary, bonuses, or other financial benefits. However, it's essential to distinguish between advances and loans, as they are subject to different legal and financial considerations.

What are common scenarios where advance payments are made?

Advance payments are typically made in situations where employees face unforeseen financial challenges or have specific, time-sensitive needs. Some common scenarios include:

- Medical emergencies: When an employee or their family member requires urgent medical care, an advance payment can provide the necessary funds to cover medical expenses.

- Unexpected expenses: Situations such as car repairs, home repairs, or other unexpected costs can prompt employees to request an advance.

- Relocation costs: If an employee is relocating for work, they may need financial support to cover moving expenses.

- Festive seasons or holidays: During festive seasons or holidays, employees may require additional funds for celebrations or travel.

- Personal events: Life events like weddings, funerals, or other personal milestones may necessitate advance payments to manage expenses.

Can I deduct my employees’ salaries for advance payments?

According to the Ministry of Manpower (MOM) in Singapore, employers can deduct an employee's salary for the recovery of advance payments. However, there are specific guidelines and limitations to ensure that the deductions are fair and transparent.

Employers can deduct the advance payment from the employee's future salaries, typically spread over a maximum period of 12 months. Each instalment should not exceed 25% of the employee's salary for that period.

It is crucial to obtain the employee's consent for the advance and the subsequent salary deductions. This consent must be documented and clearly state the terms of the repayment.

Employers should also be mindful of additional regulations that may apply, especially concerning specific categories of workers, such as foreign employees. For more detailed information on allowable salary deductions, you can refer to our "Salary Deduction guide for employers in Singapore".

Are CPF contributions payable on an advance payment given to my employee?

CPF contributions are payable on the salary due to your employee in each calendar month.

For advance salary that is not due to your employee but was given earlier, you are not required to pay CPF contributions on it yet. You will have to pay CPF contributions for the amount in the month it is payable to your employee.

However, if the advance payment is treated as a loan and not as an earned salary, CPF contributions may not be applicable. Employers must ensure they classify the advance correctly and comply with CPF regulations. For specific guidance, you can refer to the CPF Board's guidelines on advance payments.

Potential problems related to advance payments and preventive actions

While advance payments can be beneficial, they can also lead to potential issues if not managed correctly. Here are some common problems and preventive actions:

- Financial strain on employees

Large or frequent advances can lead to financial difficulties for employees, especially if repayments are high.

Preventive action: set reasonable limits on advance amounts and ensure employees understand the repayment terms.

- Impact on cash flow

For employers, providing advance payments can impact cash flow, especially if multiple employees request advances simultaneously.

Preventive action: employers should plan and budget for potential advance requests and ensure they have sufficient reserves.

- Misunderstandings and disputes

Lack of clear communication and documentation can lead to misunderstandings or disputes between employers and employees.

Preventive action: always document the terms of the advance, including the amount, repayment schedule, and any interest (if applicable).

- Compliance issues

Failing to comply with legal requirements regarding salary deductions and CPF contributions can lead to penalties and legal issues.

Preventive action: employers must stay informed about the latest regulations and seek legal advice if needed.

Best practices for managing advance payments

To manage advance payments effectively and ensure a smooth process for both employers and employees, consider the following 5 tips:

Tip #1: Clear policies and communication

Establish clear policies regarding advance payments, including eligibility criteria, approval processes, and repayment terms. Communicate these policies to employees and ensure they understand the terms before accepting an advance.

Tip #2: Documentation

Keep detailed records of all advance payments, including the date, amount, reason, and repayment schedule. This documentation should be signed by both the employer and the employee.

Tip #3: Limit advances

Set limits on the amount and frequency of advances to prevent financial strain on both the employer and the employee. Consider implementing a cap on the percentage of salary that can be advanced.

Tip #4: Financial education

Offer financial education resources or workshops to help employees manage their finances better. This can reduce the need for advance payments and promote financial well-being.

Tip #5: Regular reviews

Periodically review your advance payment policies and procedures to ensure they remain fair, transparent, and compliant with legal requirements.

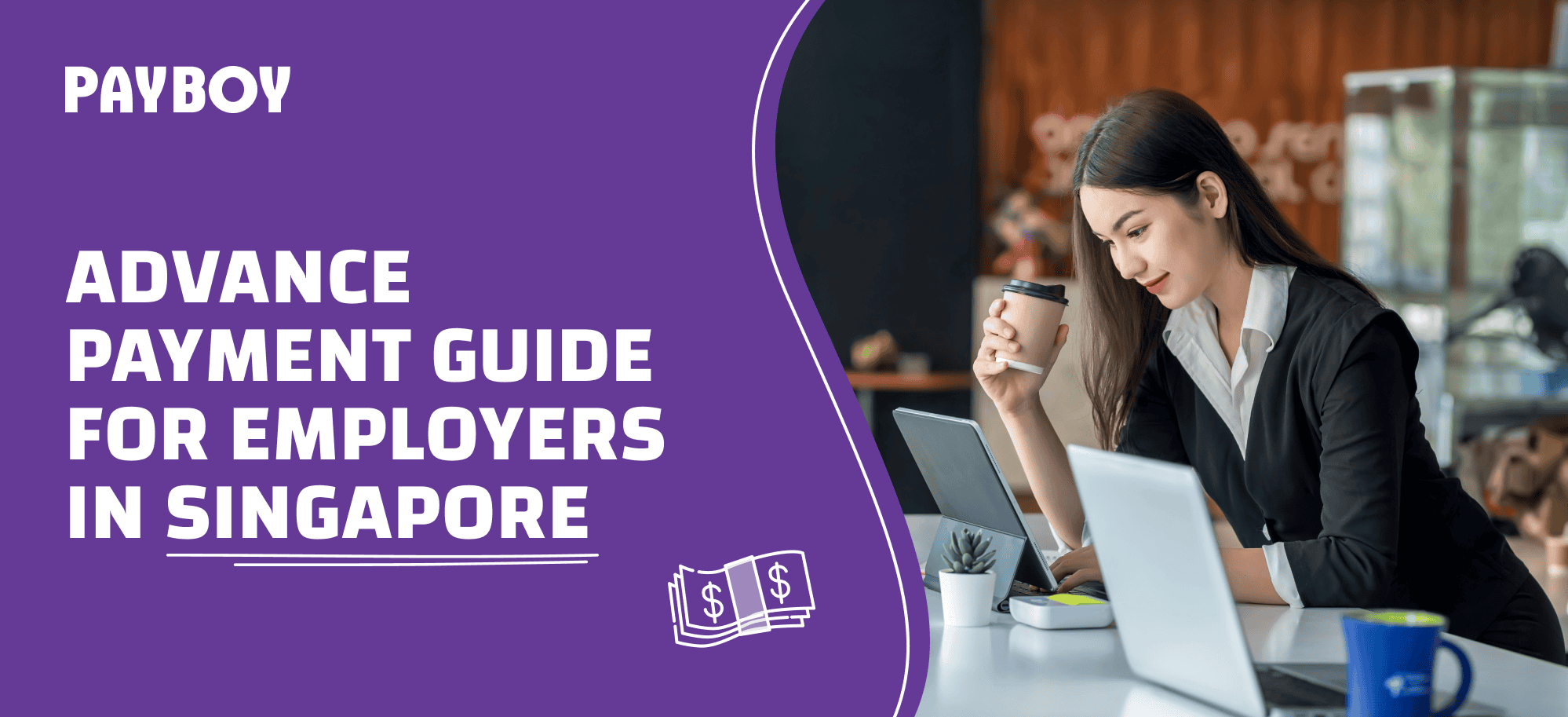

Simplify advance payments with Payboy HR and Payroll Software!

When managing advance payments, it's essential for employers to accurately adjust future salaries to comply with regulations. Be worry-free, Payboy HR and Payroll software can simplify this process!

With our fully compliant, customisable, and integrated payroll processing module, you can calculate payroll with ease with additional features that are designed to save you time and effort.

- 100% compliance and 100% peace of mind

- Forget about payroll and SDL calculations, CPF contributions, and IR8A submissions. Our software will automatically calculate them for you and keep you compliant with the latest regulations from MOM, CPF, and IRAS.

- Covers any work arrangement

- Transparent, Accurate, and Simple

- Have full visibility on how payroll is calculated automatically based on shifts, attendance, leave, and submitted claims within an intuitive experience.

- Customisable itemised payslips

- Fully integrated with your preferred platforms

- We’ll fit into your ecosystem seamlessly and keep your finance team happy. Learn more about our seamless integrations with Xero, Financio, and Quickbooks.

Streamline your HR processes with Payboy today!

As a PSG-approved HRMS, Payboy provides a robust system to help you manage your HR tasks so that you can focus on your business and people!

With our wide range of modules, you can customise a solution to meet the specific needs of your business:

Payroll Processing | Leave Management | Claims Management | Applicant Tracking

Time Attendance | Shift Scheduling | Appraisal System | Inventory Management

Project Costing | Training Management