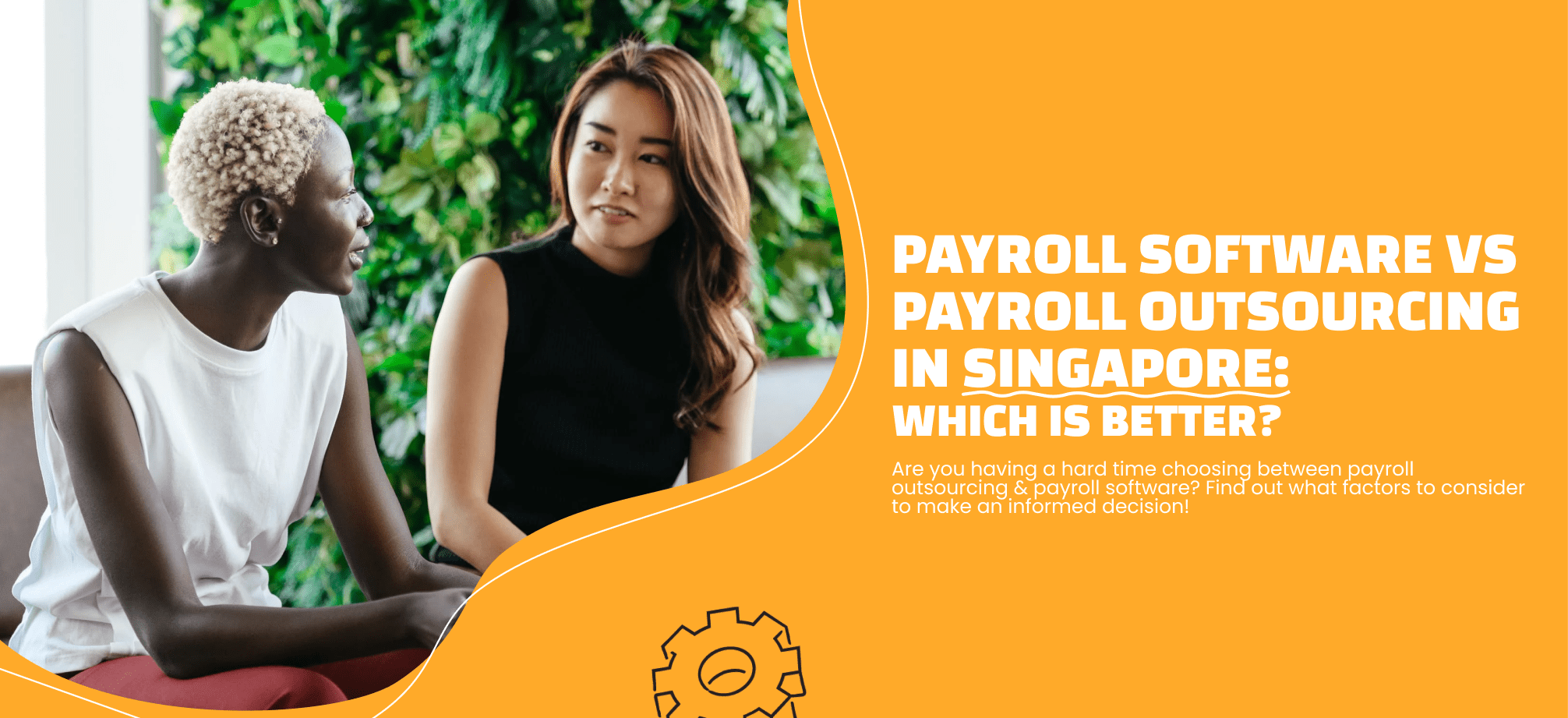

Small business owners in Singapore often face the dilemma of whether to use payroll software or outsource their payroll. Both options have their pros and cons, but which is the better choice for your business? It ultimately depends on your business’ specific needs and circumstances. Read on to find out what are some of the key factors to consider so that you can make an informed decision!

What is payroll software?

A payroll software is a programme or system that helps businesses manage and process employee payroll and taxes. This can include calculating wages, withholding the correct amount of taxes, and submitting payments to the government on behalf of the company.

Using payroll software can simplify payroll processes for both HR departments and employees, as it streamlines all payroll-related tasks into one streamlined system. Additionally, payroll software often provides other HR features such as leave management or shift scheduling, which helps to streamline and improve communication with employees.

Tip: Learn the benefits of using a payroll software and how to implement successfully in your company

What is payroll outsourcing?

Payroll outsourcing is the practice of hiring a third-party provider to manage payroll tasks for your business. This can include calculating wages, withholding taxes, and making payroll tax payments on behalf of the company.

With constantly changing regulations, outsourcing payroll can provide peace of mind with improved compliance, as these payroll specialists have the knowledge and expertise to stay updated on regulatory changes, reducing the risk of non-compliance and associated penalties.

What can an outsourced payroll service provider offer?

Outsourcing payroll functions to an external service provider is a feasible option for many businesses. The key responsibilities typically entrusted to payroll providers encompass:

- Establishing payroll accounts

- Setting up payment methods

- Monitoring employee work hours

- Calculating owed wages

- Distributing payments

- Implementing security protocols to protect company and employee data

- Ensuring adherence to governmental regulations

- Handling payroll tax withholdings, income taxes, and wage garnishments

- Administering employee deductions

- Processing payroll tax remittances

- Concluding year-end tax procedures

Factors to consider when deciding between outsourced payroll provider and payroll software

Both payroll outsourcing and payroll software have their own advantages and drawbacks. It is therefore important to consider the following factors before making a decision:

- What is your company’s size and growth potential?

Payroll software can offer a more convenient and cost-effective solution for smaller businesses with a steady employee count. On the other hand, outsourcing payroll to a provider may offer the scalability and expertise needed to handle the increased workload for larger businesses or those with complex payroll needs.

- How much control and flexibility do you want in managing your payroll process?

With payroll software, you have the ability to customise it to meet the specific needs of your business and make changes as needed.

Outsourcing gives you access to experts in payroll management but may be less flexible, as you will be working with a third-party provider who may have their own processes and procedures in place.

- Does your in-house team have the time or expertise to manage payroll?

If you have a dedicated HR and payroll team, utilising software may be a more cost-effective solution.

However, if your team lacks the experience or time to accurately handle payroll tasks, outsourcing may be a better option, as these payroll specialists have the knowledge and expertise to stay updated on regulatory changes, reducing the risk of non-compliance and associated penalties. Outsourcing can also help free up time and resources for businesses to focus on their core competencies.

Tip: Learn what are the top 5 HR tasks and how to automate them to reduce HR risks

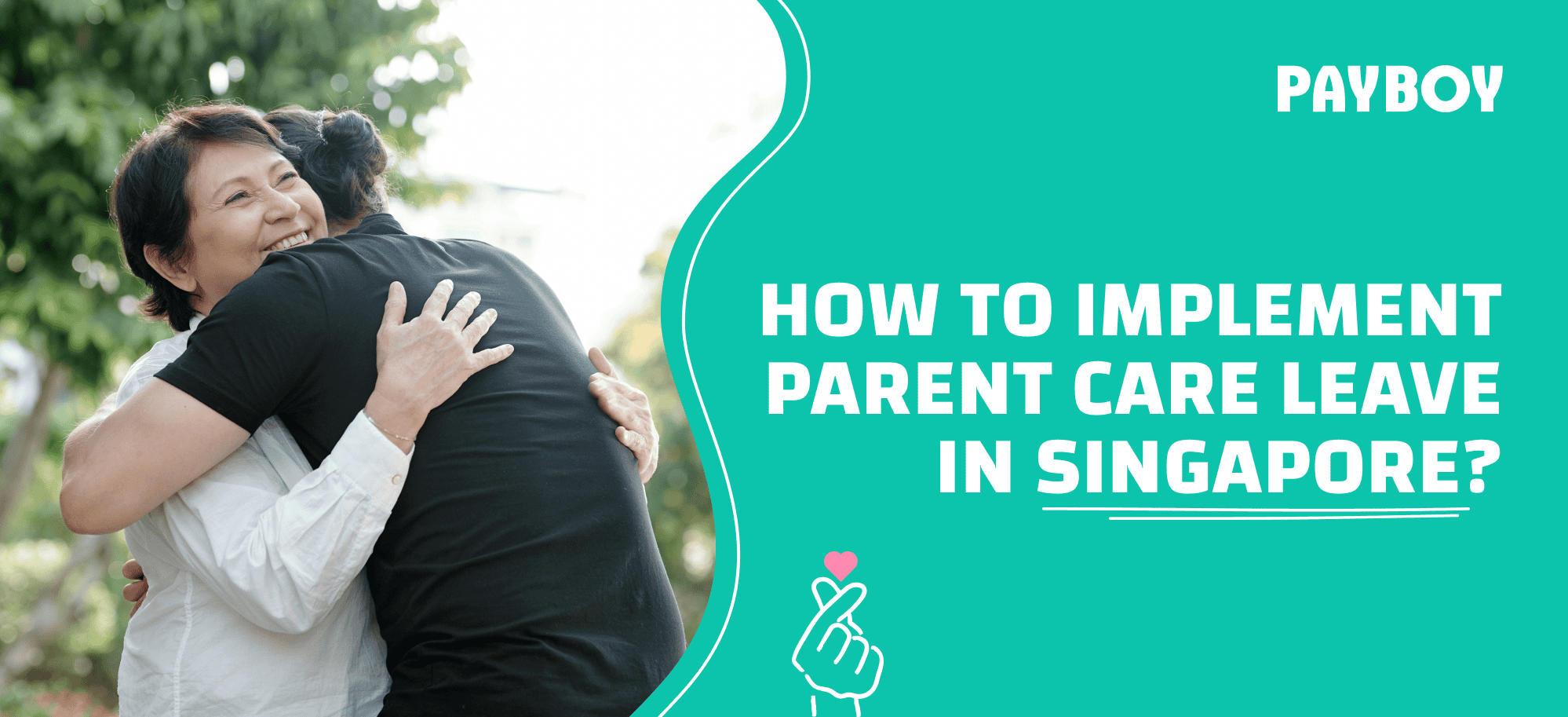

- Do you need more help managing your HR matters besides payroll processing?

Payroll software typically offers a wide range of features besides payroll processing, such as leave management, claims management, time tracking, and shift scheduling.

The outsourced payroll provider may not be able to provide all these services, such as shift scheduling or leave approvals, given that these tend to require more timely attention as they impact the daily operations.

- How do I process payroll if I have various working arrangements, like part-time, freelancer, and contractor, within my company?

When considering the various working arrangements like part-time, freelancer, and contractor, it's important to choose a payroll solution that aligns with your business needs. Payroll software offers flexibility and scalability, allowing customisation to accommodate the unique requirements of different working arrangements. It commonly incorporates features like attendance tracking, which ensures that hours worked and overtime are accurately reflected in payslips on every payment cycle.

Additionally, for businesses seeking alternative solutions, payroll outsourcing provides another avenue to manage payroll effectively. Outsourcing your payroll functions to external experts can offer convenience and time-saving benefits, especially for businesses with limited payroll expertise or resources. This approach allows you to delegate comprehensive payroll tasks to professionals while retaining control over other aspects of your business operations.

- Are you planning to stay local or expand regionally?

It is important to consider the specific needs and regulations of the region in which you operate. Payroll processes can vary greatly from country to country, and choosing a solution that does not comply with regional laws and regulations could result in penalties for your business.

For example, in some countries, there may be mandatory contributions to social security or pension funds that must be made on behalf of employees. In others, there may be specific rules regarding payroll taxes and deductions.

An experienced payroll outsourcing provider will have an in-depth understanding of regional payroll needs and requirements, ensuring compliance and avoiding potential penalties. Alternatively, if you choose to use payroll software, it is important to ensure that it is equipped to handle the specific needs of the regions that you are operating in.

Overall, there is no one-size-fits-all solution for payroll management. It's important to continuously reassess and adapt as your business grows and changes.

What are the next steps to conduct thorough research between payroll software and payroll outsourcing?

Here are some recommendations to help you conduct a comprehensive evaluation and make an informed decision:

Step #1: Read reviews and testimonials

Look for independent reviews and testimonials from other businesses that have used payroll software or outsourcing services. Pay attention to both positive and negative feedback to get a balanced perspective.

Step #2: Attend webinars and demos

Many payroll software providers and outsourcing firms offer webinars, demos, and online workshops to showcase their solutions. Attend these events to gain a better understanding of how their offerings work and whether they meet your needs.

Step #3: Compare features and pricing

Create a spreadsheet to compare the features, functionalities, and pricing plans of different payroll software and outsourcing options. Consider factors such as ease of use, compliance capabilities, customer support, and scalability.

Step #4: Request proposals and quotes:

Once you have shortlisted a few potential payroll software vendors or outsourcing partners, request detailed proposals or quotes. Review these documents carefully to understand the scope of services, implementation timelines, and costs involved.

Step #5: Evaluate integration capabilities:

If you currently use other business software or systems (such as accounting software or HR management tools), consider how well the payroll solution integrates with these existing systems. Seamless integration can streamline your workflows and data management processes.

Step #6: Consider compliance and security:

Ensure that the payroll software or outsourcing provider complies with relevant regulations and data security standards. Look for certifications or accreditations that demonstrate their commitment to safeguarding sensitive employee information.

Step #7: Seek expert advice

If you're still unsure about which option is best for your business, consider seeking advice from HR consultants, financial advisors, or industry experts. They can offer valuable insights and guidance based on their knowledge and experience.

Can I use both outsourcing payroll providers and payroll software?

Yes, it is possible to use both outsourced payroll providers and payroll software for your business! Some companies choose to outsource their payroll processes but also utilise software to manage certain HR matters such as leave approvals, expense management, and shift scheduling. Ultimately, it is up to your specific needs and preferences as a business owner.

Some advantages of using both options include having access to expert outsourced payroll professionals as well as the convenience and efficiency of automated software systems. However, it is important to carefully consider the cost-benefit analysis and ensure that both options integrate smoothly with your company's unique payroll and HR requirements. Overall, using a combination of outsourcing and software can be a great solution for effectively managing employee payroll and other HR matters.

Automate your payroll matters with Payboy HR Software!

With our fully compliant, customisable, and integrated payroll processing module, you can automate the preparation of payroll for your employees and also enjoy additional features that are designed to save you time and effort:

- 100% compliance and 100% peace of mind

-

-

- Forget about payroll and SDL calculations, CPF contributions, and IR8A submissions. Our software will automatically calculate them for you and keep you compliant with the latest regulations from MOM, CPF, and IRAS.

- Covers any work arrangement

-

-

- Transparent, Accurate, and Simple

-

-

- Have full visibility on how payroll is calculated automatically based on shifts, attendance, leave, and submitted claims within an intuitive experience.

- Customisable itemised payslips

-

-

- Fully integrated with your preferred platforms

-

- We’ll fit into your ecosystem seamlessly and keep your finance team happy. Learn more about our seamless integrations with Xero, Financio, and Quickbooks.

As a PSG-approved HRMS, Payboy also provides a robust system to help you manage your HR tasks so that you can focus on your business and people!

With our wide range of modules, you can customise a solution to meet the specific needs of your business:

Payroll Processing | Leave Management | Claims Management | Applicant Tracking

Time Attendance | Shift Scheduling | Appraisal System | Inventory Management

Project Costing | Training Management

Looking to outsource your payroll services?

Our HR consultancy partner, The Growth Project, offers comprehensive payroll services, including:

- Payroll processing

- CPF submission

- Income tax filing and compliance

- Year-end forms submission (IR8A and IR21)

Schedule a free 30-minute consultation with The Growth Project to learn how they can simplify the payroll processing process for you!